Battery Tab Welding Automation Industry Report 2025: Market Growth, Technology Innovations, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Battery Tab Welding Automation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: Opportunities and Hotspots

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Industry Roadmap

- Sources & References

Executive Summary & Market Overview

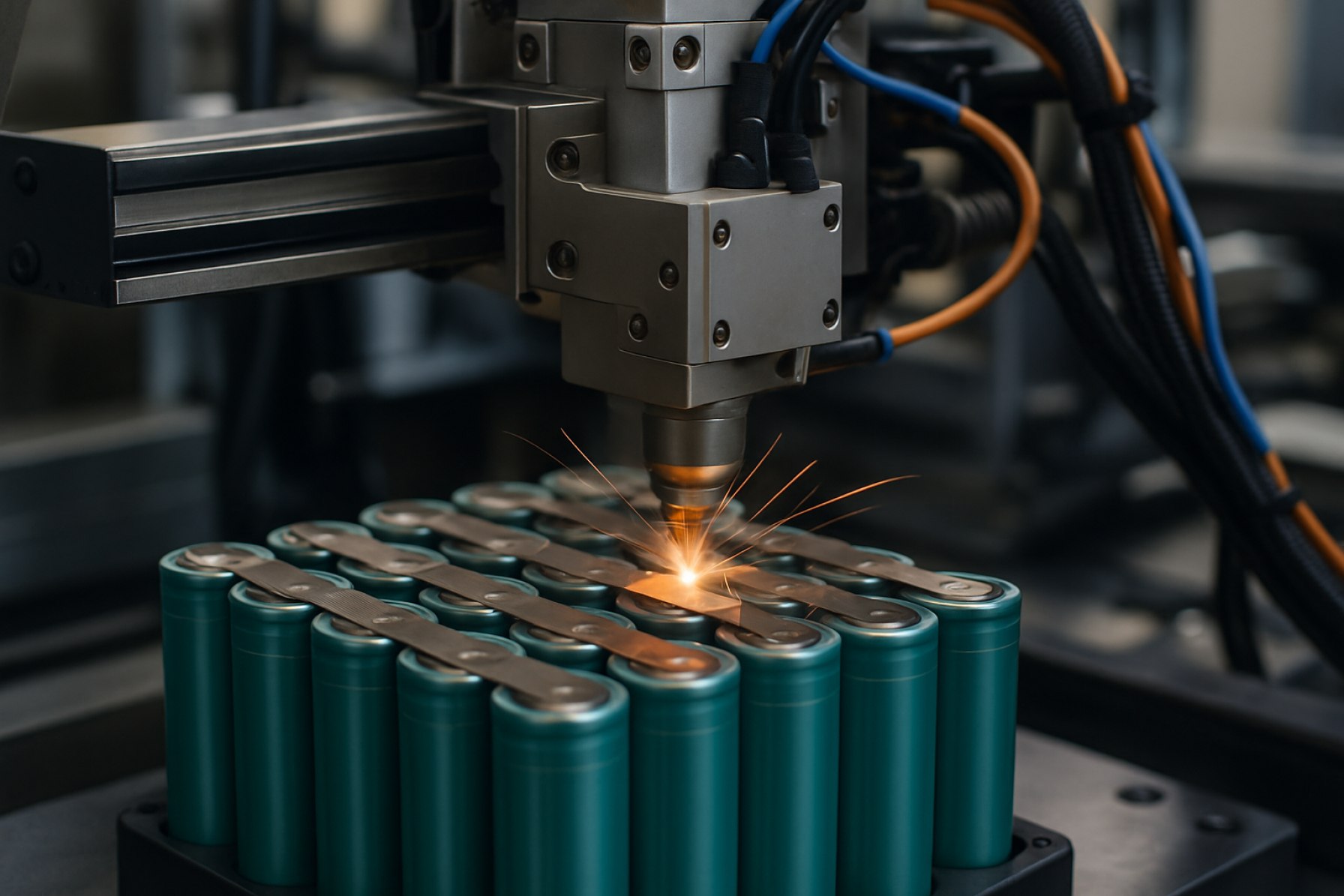

Battery tab welding automation refers to the use of advanced machinery and robotics to automate the process of welding tabs—thin metal connectors—onto battery cells, a critical step in the assembly of lithium-ion batteries. This technology is pivotal in the production of batteries for electric vehicles (EVs), consumer electronics, and energy storage systems, where precision, speed, and reliability are paramount.

The global market for battery tab welding automation is experiencing robust growth, driven by the accelerating adoption of electric vehicles and the expansion of renewable energy storage solutions. According to Bloomberg, global EV sales are projected to surpass 16 million units in 2025, up from 10.5 million in 2022, intensifying demand for high-throughput, automated battery manufacturing solutions. Automation in tab welding not only increases production capacity but also enhances weld quality and consistency, reducing the risk of defects that can compromise battery safety and performance.

Key players in the battery manufacturing equipment sector, such as Panasonic, Tesla, and Hitachi High-Tech, are investing heavily in automation technologies to streamline their production lines. The integration of laser and ultrasonic welding systems, coupled with machine vision and AI-driven quality control, is becoming standard practice among leading manufacturers. According to IDTechEx, the global market for battery manufacturing equipment—including tab welding automation—is expected to reach $70 billion by 2025, reflecting a compound annual growth rate (CAGR) of over 20% from 2020.

- Asia-Pacific remains the dominant region, with China, South Korea, and Japan leading in both battery production and automation adoption.

- Europe and North America are rapidly scaling up domestic battery manufacturing, spurred by government incentives and the localization of EV supply chains.

- Technological advancements, such as real-time process monitoring and predictive maintenance, are further enhancing the efficiency and reliability of automated tab welding systems.

In summary, battery tab welding automation is a critical enabler of the next generation of battery manufacturing, supporting the global shift toward electrification and sustainable energy. The market outlook for 2025 is highly positive, underpinned by strong end-user demand, technological innovation, and strategic investments by industry leaders.

Key Technology Trends in Battery Tab Welding Automation

Battery tab welding automation is undergoing rapid transformation as manufacturers strive to meet the demands of high-performance batteries for electric vehicles (EVs), consumer electronics, and energy storage systems. In 2025, several key technology trends are shaping the landscape of battery tab welding automation, driven by the need for higher throughput, improved weld quality, and greater flexibility in production lines.

- Laser Welding Advancements: The adoption of advanced laser welding techniques, such as ultrafast fiber lasers and blue diode lasers, is accelerating. These technologies offer superior precision, minimal heat-affected zones, and the ability to weld dissimilar metals—critical for next-generation battery chemistries. Companies like TRUMPF and Coherent are leading the integration of these solutions into automated systems.

- AI-Driven Process Control: Artificial intelligence and machine learning are increasingly embedded in welding automation platforms. Real-time monitoring and adaptive control algorithms enable predictive maintenance, automatic parameter adjustments, and defect detection, reducing scrap rates and downtime. ABB and Siemens are at the forefront of deploying AI-powered quality assurance in battery manufacturing.

- Flexible Robotic Integration: The shift toward modular, reconfigurable robotic cells allows manufacturers to quickly adapt to new battery formats and tab designs. Collaborative robots (cobots) are being deployed for tasks requiring dexterity and safety, enhancing both productivity and worker ergonomics. KUKA and FANUC are notable providers of such flexible automation solutions.

- Inline Quality Inspection: Non-destructive testing (NDT) methods, such as machine vision and ultrasonic inspection, are now integrated directly into welding lines. This enables 100% inspection of welds in real time, ensuring compliance with stringent automotive and consumer electronics standards. KEYENCE and ZEISS are advancing inline inspection technologies for battery tab welding.

- Data Connectivity and Industry 4.0: Battery tab welding automation is increasingly connected to plant-wide Manufacturing Execution Systems (MES) and cloud platforms, enabling data-driven optimization and traceability. This connectivity supports continuous improvement and regulatory compliance, as highlighted by Rockwell Automation and Schneider Electric.

These trends are collectively enabling battery manufacturers to achieve higher yields, lower costs, and faster innovation cycles, positioning automated tab welding as a cornerstone of the evolving battery supply chain in 2025.

Competitive Landscape and Leading Players

The competitive landscape for battery tab welding automation in 2025 is characterized by rapid technological advancements, increasing investments, and a growing number of specialized players. As the demand for lithium-ion batteries surges—driven by electric vehicles (EVs), energy storage systems, and consumer electronics—manufacturers are prioritizing automation to enhance production efficiency, consistency, and quality. This has led to a dynamic market where established industrial automation firms and innovative startups compete to deliver advanced welding solutions tailored to battery manufacturing.

Key players in the battery tab welding automation sector include Panasonic Corporation, Amada Co., Ltd., Fronius International GmbH, and Dukane Corporation. These companies offer a range of automated welding systems, including ultrasonic, laser, and resistance welding technologies, each suited to different battery chemistries and production scales. For instance, Panasonic has expanded its portfolio with high-speed laser welding systems designed for EV battery lines, while Fronius focuses on precision resistance welding solutions for cylindrical and prismatic cells.

In addition to these global leaders, regional players such as Shenzhen JPT Opto-electronics Co., Ltd. and Han’s Laser Technology Industry Group Co., Ltd. have gained significant traction, particularly in Asia-Pacific, which remains the largest battery manufacturing hub. These companies leverage local market knowledge and cost-effective engineering to compete with multinational firms, often forming partnerships with battery OEMs to co-develop customized automation lines.

The competitive environment is further intensified by the entry of robotics and automation specialists like ABB Ltd. and KUKA AG, who integrate advanced robotics, machine vision, and AI-driven quality control into welding automation. This integration enables higher throughput and real-time defect detection, addressing the stringent quality requirements of automotive and grid-scale battery applications.

Strategic collaborations, R&D investments, and the push for Industry 4.0 adoption are shaping the competitive dynamics. Companies are increasingly offering modular, scalable solutions to accommodate evolving battery designs and production volumes. As a result, the market is expected to remain highly competitive, with innovation and customization as key differentiators in 2025.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The battery tab welding automation market is poised for robust growth between 2025 and 2030, driven by the accelerating adoption of electric vehicles (EVs), energy storage systems, and advancements in battery manufacturing technologies. According to projections by MarketsandMarkets, the global market for battery tab welding automation is expected to register a compound annual growth rate (CAGR) of approximately 8.5% during this period. This growth is underpinned by increasing investments in gigafactories and the push for higher production efficiency and consistency in lithium-ion battery assembly.

Revenue forecasts indicate that the market, valued at around USD 1.2 billion in 2024, could surpass USD 2.1 billion by 2030. This surge is attributed to the scaling up of automated production lines, particularly in Asia-Pacific, where countries like China, South Korea, and Japan are leading in battery manufacturing capacity. Benchmark Mineral Intelligence reports that over 70% of new battery manufacturing facilities announced for 2025–2030 will incorporate advanced automation solutions, including laser and ultrasonic tab welding systems.

In terms of volume, the number of automated tab welding units shipped globally is projected to grow from approximately 3,500 units in 2025 to over 7,000 units by 2030. This doubling in volume reflects not only the expansion of existing battery plants but also the entry of new players in the market, particularly in Europe and North America, where government incentives are spurring local battery production. IDTechEx highlights that the adoption of automation in tab welding is critical for meeting the stringent quality and throughput requirements of next-generation battery cells, such as those used in solid-state and high-energy-density applications.

- Asia-Pacific will remain the dominant region, accounting for over 60% of global revenue by 2030.

- Laser welding automation is expected to outpace ultrasonic welding in growth rate, due to its precision and suitability for new battery chemistries.

- Automotive OEMs and battery cell manufacturers will be the primary end-users, with increasing adoption in stationary energy storage sectors.

Overall, the 2025–2030 period will see battery tab welding automation become a cornerstone of competitive battery manufacturing, with market growth closely tied to the global electrification trend and the race for higher-performing, safer batteries.

Regional Market Analysis: Opportunities and Hotspots

The regional landscape for battery tab welding automation in 2025 is shaped by the accelerating global demand for lithium-ion batteries, particularly in electric vehicles (EVs), consumer electronics, and energy storage systems. Key opportunities and market hotspots are emerging in Asia-Pacific, North America, and Europe, each driven by distinct industrial dynamics and policy frameworks.

Asia-Pacific remains the dominant region, accounting for the largest share of battery manufacturing and, consequently, the highest adoption of tab welding automation. China, South Korea, and Japan are at the forefront, propelled by aggressive investments in gigafactories and government incentives for EV production. According to Benchmark Mineral Intelligence, China alone is expected to host over 60% of global lithium-ion battery manufacturing capacity by 2025, creating substantial demand for advanced welding automation to ensure quality, throughput, and cost efficiency. South Korea and Japan, home to major battery manufacturers like LG Energy Solution and Panasonic, are also investing in next-generation welding technologies to maintain competitiveness and meet stringent safety standards.

North America is rapidly emerging as a strategic hotspot, fueled by the U.S. Inflation Reduction Act and a surge in domestic battery manufacturing projects. Companies such as Tesla and General Motors are scaling up production, driving demand for highly automated tab welding solutions to support large-scale, high-mix battery assembly lines. The region’s focus on reshoring supply chains and reducing reliance on Asian imports further amplifies the need for advanced automation, with a particular emphasis on laser and ultrasonic welding technologies for improved precision and reliability.

- Europe is witnessing robust growth, underpinned by the European Union’s Green Deal and ambitious targets for EV adoption. Countries like Germany, Sweden, and Hungary are attracting significant investments in battery gigafactories from players such as Northvolt and CATL. The region’s stringent environmental and quality regulations are accelerating the adoption of automated tab welding systems, especially those that enable traceability and real-time quality monitoring.

In summary, the most lucrative opportunities for battery tab welding automation in 2025 are concentrated in regions with aggressive battery manufacturing expansion, strong policy support, and a focus on quality and efficiency. Asia-Pacific leads in scale, North America in strategic reshoring, and Europe in regulatory-driven innovation, making these regions the primary hotspots for market growth.

Challenges, Risks, and Emerging Opportunities

Battery tab welding automation is a critical enabler for the mass production of advanced lithium-ion batteries, especially as demand surges in electric vehicles (EVs), consumer electronics, and energy storage systems. However, the sector faces a complex landscape of challenges and risks, even as new opportunities emerge for technology providers and manufacturers in 2025.

One of the primary challenges is the need for extreme precision and consistency in welding processes. Battery tabs are often made from thin, highly conductive materials such as copper and aluminum, which are sensitive to heat and prone to defects like spatter, burrs, or microcracks if not welded under tightly controlled conditions. Automation systems must integrate advanced sensors, machine vision, and real-time quality monitoring to ensure weld integrity and prevent costly failures downstream. The rapid evolution of battery chemistries and cell formats—such as the shift toward solid-state batteries and larger cylindrical cells—further complicates automation, requiring flexible and easily reconfigurable welding solutions (Frost & Sullivan).

Supply chain volatility and geopolitical risks also pose significant threats. The battery manufacturing ecosystem is highly globalized, with key automation components and welding equipment sourced from specialized suppliers in Asia, Europe, and North America. Disruptions—whether from trade tensions, export controls, or raw material shortages—can delay automation projects and increase costs (McKinsey & Company). Additionally, the high capital expenditure required for state-of-the-art automated welding lines can be a barrier for smaller manufacturers, especially as the industry faces margin pressures and fluctuating demand forecasts.

Despite these risks, several emerging opportunities are reshaping the competitive landscape. The push for gigafactories and regionalized battery production in the US and Europe is driving demand for localized automation solutions and after-sales support (Benchmark Mineral Intelligence). Innovations in laser and ultrasonic welding technologies are enabling faster, cleaner, and more energy-efficient processes, opening new markets for equipment vendors. Furthermore, the integration of artificial intelligence and predictive analytics into welding automation is enhancing process optimization, reducing downtime, and enabling adaptive manufacturing—key differentiators as battery designs continue to evolve.

In summary, while battery tab welding automation in 2025 faces technical, economic, and geopolitical headwinds, it also presents significant growth opportunities for agile players that can deliver flexible, high-quality, and digitally enabled solutions.

Future Outlook: Strategic Recommendations and Industry Roadmap

The future outlook for battery tab welding automation in 2025 is shaped by accelerating demand for electric vehicles (EVs), energy storage systems, and consumer electronics, all of which require high-performance lithium-ion batteries. As manufacturers scale up production, the need for advanced, reliable, and cost-effective tab welding automation becomes paramount. Strategic recommendations and an industry roadmap for stakeholders are outlined below, based on current trends and anticipated market developments.

- Invest in Next-Generation Welding Technologies: Laser welding, particularly fiber and ultrafast lasers, is expected to dominate due to its precision, speed, and minimal thermal impact on battery cells. Companies should prioritize R&D in these areas to enhance process reliability and accommodate evolving battery chemistries and formats (TRUMPF Group).

- Adopt Modular and Flexible Automation Platforms: Battery manufacturers are increasingly seeking modular automation solutions that can be rapidly reconfigured for different cell types (pouch, prismatic, cylindrical) and production volumes. Investing in flexible automation platforms will enable faster adaptation to market shifts and new product introductions (ABB).

- Integrate Advanced Quality Control and Data Analytics: Inline inspection systems using machine vision and AI-driven analytics are critical for ensuring weld quality and traceability. Automation providers should embed these capabilities to minimize defects and support predictive maintenance, reducing downtime and scrap rates (Keyence Corporation).

- Strengthen Supply Chain Collaboration: As battery gigafactories proliferate, close collaboration between automation vendors, battery cell manufacturers, and material suppliers will be essential. Joint development programs and standardized interfaces can accelerate deployment and interoperability across the value chain (Contemporary Amperex Technology Co. Limited (CATL)).

- Prioritize Sustainability and Energy Efficiency: Automation solutions should be designed to minimize energy consumption and material waste, aligning with global sustainability goals and regulatory requirements. This includes optimizing welding parameters and recycling scrap materials (International Energy Agency (IEA)).

In summary, the 2025 roadmap for battery tab welding automation emphasizes technological innovation, flexible manufacturing, data-driven quality assurance, collaborative ecosystems, and sustainability. Companies that proactively address these areas will be best positioned to capture growth opportunities in the rapidly expanding battery sector.

Sources & References

- Hitachi High-Tech

- IDTechEx

- TRUMPF

- Coherent

- ABB

- Siemens

- KUKA

- FANUC

- ZEISS

- Rockwell Automation

- Amada Co., Ltd.

- Fronius International GmbH

- Dukane Corporation

- Han’s Laser Technology Industry Group Co., Ltd.

- ABB Ltd.

- MarketsandMarkets

- Benchmark Mineral Intelligence

- General Motors

- Northvolt

- CATL

- Frost & Sullivan

- McKinsey & Company

- International Energy Agency (IEA)